Treat Your Mom this Mother’s Day (and Invest a Little in Yourself, Too!)

Have you already bought your mom something special for Mother’s Day? If you are behind on your shopping, don’t panic! There is still time to get her something thoughtful, meaningful, and memorable. Sure, it’s not the first thing people think of when they think “Mom,” but it is incredibly important.

Have you already bought your mom something special for Mother’s Day? If you are behind on your shopping, don’t panic! There is still time to get her something thoughtful, meaningful, and memorable. Sure, it’s not the first thing people think of when they think “Mom,” but it is incredibly important.

We’re talking about creating a plan. A plan for if Mom gets ill or becomes incapacitated as she gets older. A plan for how she wants to be remembered and the gifts she wants to give her children and children’s children. A plan for what will happen when she passes.

Not So Fast, It’s Not as Morbid as You Think

We can pretty much guarantee your mom has thought about death before. She’s thought about what would happen if she got sick before. She’s even thought about how best to maximize the years she has with her children and (if applicable) grandchildren. But, has she taken action on those thoughts? Chances are, she hasn’t. Why? Because she’s uncomfortable, or scared, or doesn’t know how to start, or doesn’t want to do it alone. No matter her reasons, she likely just needs a little support.

That’s where you come in. Your mom needs you to stand by her, to let her know you are on her team, and to help her take the necessary steps to ease her worrying. If your mom is like most moms, what she wants more than anything this Mother’s Day is to spend a little time with her kids. Quality, one-on-one time for bonding, laughing, and making memories. What better way than to spend the day with her having these important conversations?

What a Difference a Plan Can Make

Imagine the difference:

Your mom becomes ill or is unable to care for herself, and there is no plan in place. You’ve never even had a conversation with her on this subject. So, who makes the medical decisions? Who is in charge of taking care of her house? If she passes, what are her funeral wishes? How does she want her stuff distributed?

By contrast, imagine a situation in which each scenario has been discussed, roles are assigned to loved ones, and everyone knows the plan. When challenging moments arise, the decisions have already been made — all the family needs to do is execute the plan. There will still be stress, sadness, and grief, but there won’t be a fight.

You Don’t Have to Do it Alone

Ok, maybe this does sound like a good idea — taking the day to have conversations with your mom about what she wants in life and how she wants to be remembered after her passing — but are you really qualified to have these conversations? They sound intense, and possibly explosive. Where would you even begin?

Here’s the best news you may have heard all day: you don’t have to do it alone! There are compassionate professionals out there who are experienced in guiding these kinds of conversations. There are even some (cough, cough) who run a family business themselves, who were raised by a single mom, and who know how essential and fragile these conversations can be. Let us help!

At the Trust Brothers, we specialize in helping families move through these difficult conversations and create plans that bring ease for the future.

There’s Something in it for You, Too!

This may not be the best reason to highlight in front of Mom, but there’s a huge personal benefit for you if Mom gets her affairs in order. First, as we mentioned, a clear plan and an open discussion eases stress and conflict when difficult moments arise. But, there is also a very real financial benefit to making a plan with an attorney. It’s called probate-avoidance.

If your mom has no plan in place at all (not even a standard Last Will and Testament), you will find yourself in probate court navigating the process of trying to get her stuff released to you and any other heirs. If you live in a different state from your mom, that involves traveling back and forth to her home county, hiring a local attorney, having all of these proceedings put on the public record, and waiting a minimum of twelve months for the whole messy process to end. Now here’s something a lot of people don’t know, even if your mom does have a Last Will and Testament, you will still need to go through the exact same probate process. Nothing changes: the waiting time, the public recording of all of your mom’s stuff, the hiring of a local attorney, and, especially, the cost of probate.

You may have heard that probate is expensive. Trust us, it’s all true. Probably even more expensive than you realize. Here in California, the cost of probate ranges from 3-7% of the entire value of your mom’s estate. That means, if she owns her home and a few bank accounts to the tune of $625,000, you stand to lose around $30,000 right off the top. That doesn’t even include any outstanding debts she may owe or any additional costs you may need to pay.

But, there is a way to avoid probate and that $30,000 bill. It’s called a probate-avoidance trust. This document is something you can set up with your mom right now to completely take her estate out of the probate process. You won’t need to go to court, the stuff won’t be put on the public record, you won’t need to hire a local attorney and pay the associated costs of probate, and you won’t need to wait any time at all to access your inheritance. So, we really mean it when we say making sure your mom has a plan in place is an investment in your own future. Not only will it save you time, travel, stress, and inconvenience, it may just save you a boatload of money.

Trust in the Trust Brothers This Mother’s Day

So, now that you know the situation, let us sweeten the pot. It’s Mother’s Day after all, right?

This week, treat your mom to a special lunch and a day of estate planning togetherness. We will help you dive into these conversations in a way that’s gentle, compassionate, and clear. She will love spending the time with you and getting these worries off her mind. You will love how easy the process is and how much anguish (and cash) it will save you down the road.

Take advantage of our special Mother’s Day Offer: 10% off any probate-avoidance estate planning package with the Trust Brothers when you book your appointment in the month of May. Call our office today and mention this offer to get on our schedule. Our number is (626) 331-1515.

You Don’t Want Your Ex Pulling the Plug on You…Do You?

Often, the estate planning conversation is all about money. We talk about transferring money and property from one generation to the next and how to save as much as possible. While all that money stuff is still true, there is an even more immediate aspect of estate planning that we have to talk about: what happens before you die, if you are injured, ill, or otherwise incapacitated?

Often, the estate planning conversation is all about money. We talk about transferring money and property from one generation to the next and how to save as much as possible. While all that money stuff is still true, there is an even more immediate aspect of estate planning that we have to talk about: what happens before you die, if you are injured, ill, or otherwise incapacitated?

Who Gets to Make the Decisions if You are Unable to Do So Yourself?

Have you ever asked yourself this question: who gets to make the decisions if you are unable to do so yourself? In this context, we are talking about all decisions: financial, medical, legal. Do you know? If you don’t have any documents in place authorizing certain people to make these decisions on your behalf, a court will end up appointing someone for you. What if the person the court chooses isn’t who you would choose yourself? What if the court lands on the right person, but you’ve never had a conversation with them about what you want them to do?

First, Definitions

Ok, before we get ahead of ourselves, let’s back up a minute and do definitions. There are three main documents we are talking about when we talk about decision-making and incapacity:

- Power of Attorney – this is a legal document that allows you to appoint someone to make financial and legal decisions on your behalf.

- Advance Medical Directive – in this document, you are able to select a person who can make medical decisions on your behalf if you are unable to communicate your wishes to your healthcare providers.

- HIPAA Authorization – this short but incredibly important document acts as a release that allows your healthcare providers to discuss your private medical information with a particular person.

Without these three documents in place, your family members, friends, and significant other may not be able to participate in your medical care (they may not even be allowed to get the full story about your condition from a doctor) without court intervention. And what about your financial obligations? Let’s take a deeper dive into each of these three documents.

Let’s Take Things a Little Deeper with POAs

Imagine you are in a car accident and you are temporarily unable to communicate. While you are in the hospital recuperating, who will pay your rent? Who is entitled to access your business bank accounts to pay your employees? What about taxes? What about credit card payments? The list goes on and on.

POAs are used to solve these problems by authorizing a trusted individual to step in on your behalf if you ever need a financial and legal representative. There are two kinds of POAs: springing and durable. A springing POA comes into effect when you become incapacitated. A durable POA goes into effect as soon as it is signed. There are pros and cons to each.

A durable POA is always in effect, so it allows your appointed representative to take on your financial and legal duties immediately when you are injured or become ill. However, you would really only want to use this method if you trust your appointed individual implicitly. The fact that the POA goes into effect as soon as it is signed means that your representative could, in theory, actually take control of your finances or legal decisions even if you aren’t incapacitated.

That’s where a springing POA comes in. A springing POA only goes into effect when you become incapacitated, basically eliminating any risk that the person you choose would take over your decision-making without you needing them to do so. But, the challenge with springing POAs is that they don’t immediately go into effect. A court would need to determine that you were, in fact, incapacitated to make the springing POA effective. Make sense?

Keep Your Loved Ones in the Loop with Medical Authorizations

Let’s continue with the same scenario as above: you are in a car accident and are temporarily unable to communicate. Your long-time boyfriend or girlfriend rushes to the hospital. They want to talk to the doctor. They want to know what’s going on. Maybe the doctors have a choice of treatments, and they need to know what you would prefer. Without an Advance Medical Directive and HIPAA Authorization, not only can your partner not share your wishes with your healthcare providers, he or she can’t even get an update about your condition.

Ok, so your partner goes to the court to get authorization to give input on your medical condition. But wait, you aren’t married, and there is someone else — say, a family member you aren’t particularly close to — who shows up and wants to be authorized instead. What’s going to happen? It’s hard to say, but you certainly won’t be able to give your input. That’s why an Advance Medical Directive is so important. It not only allows you to appoint a Healthcare Proxy who can make medical decisions on your behalf, it also allows you to state your preferences for care and end-of-life decisions right in the document. Super important, huh?

Avoiding the Uncomfortable, Keep Your Documents Updated and Accessible

Even if you have completed these documents in the past, it’s important to update them regularly. Keep them in a place that is easy to access and make sure that trusted family members know where to find them. Maybe even send a copy to each of the individuals you appoint. Your documents do you no good if they can’t be found when they are needed. Similarly, if they are out of date, they may be worse than useless.

This all brings us to the title of this article: you don’t want your ex pulling the plug on you…do you? Depending on the ex, we may only be exaggerating a bit, maybe not at all. If your documents are outdated, or if you haven’t revisited them in a while, they can create some tragic results. If you are seriously injured or ill and financial, legal, or medical decision-making falls to the person you’ve appointed in your documents, you better be sure that those documents authorize the right person. It can be a matter of life and death.

Get in Touch with the Trust Brothers to Get these Essential Documents in Place

So, what now? Give the Trust Brothers a call to get these documents in place or update your old, outdated documents. We can talk about how to save yourself and your loved ones money, too. But let’s start with the most important stuff.

‘Til Death Do Us Part: Wills & Trusts for the Happy Couple

It’s wedding season! Once again, we ring in the springtime with wedding bells and a flurry of “I dos.” From the moment you “kiss the bride (or groom),” break the glass, or bind your hands together, your relationship with your partner takes on a new financial and legal meaning. As a newly married couple, you are now entitled to certain benefits that come with marriage, as well as some added responsibilities.

It’s wedding season! Once again, we ring in the springtime with wedding bells and a flurry of “I dos.” From the moment you “kiss the bride (or groom),” break the glass, or bind your hands together, your relationship with your partner takes on a new financial and legal meaning. As a newly married couple, you are now entitled to certain benefits that come with marriage, as well as some added responsibilities.

These responsibilities, including being there for one another “in sickness and in health,” do take some advance planning. However, this doesn’t have to be a painful process, as long as you take care of it well in advance. Around the Trust Brothers’ office, we recommend taking care of this planning as early as possible in your married life. If you don’t yet own a home or have children, now is the perfect time to create a plan that can be easily updated and adapted as your family grows and changes. If you and your spouse are entering into marriage with children from previous relationships, creating a plan becomes absolutely essential. Blended families are a beautiful thing, but they are not reflected in the default laws of California. You will need to craft a unique plan to protect your unique family.

This is a hectic and exciting time in your life, and creating a will or a trust can be a stabilizing and rejuvenating part of your first marital year. If you are tying the knot this wedding season, take a look at this quick, five-step guide to estate planning for newlyweds.

- Let’s Start from the Top: Draft Your Wills and/or Trusts.

Most couples are married without previous plans in place, but even if you do have a will from prior to your marriage, it will need to be updated given the recent changes in your life. Drafting a will and determining whether you need a probate-avoidance trust are important steps for new couples to take together. Often, it is a process that leads to important discussions about wealth, debt, legacy, and values (don’t worry, an experienced professional will help you talk through these important topics). With a plan in place, newlyweds can begin their lives together with a clean slate and a clear view of the future.

- Update All Beneficiary Designations.

Don’t forget to do this step! This one is incredibly important because a simple mistake can cause dire consequences. Any financial accounts that you and your spouse owned separately before you were married have what is called a “beneficiary designation.” You may or may not remember filling out this form when you opened your accounts. Basically, this is a form that the financial institution keeps on file and names a particular individual (or entity) that will automatically take ownership of that account when you pass away. Depending on when you opened the accounts, you may have chosen to list a parent, a previous partner, or anyone else who was important in your life at that time.

It is likely you filled out a form like this for all of your financial accounts, including your 401k, IRA, brokerage accounts, and bank accounts. Here’s the kicker: getting married or creating a will does not change your beneficiary designations. The form you signed is superior in the eyes of the law than your will, so whoever you wrote down will inherit that account…unless you update it. One of the most important things you can do as newlyweds is to go back through all of your beneficiary designations and ensure that you have listed your spouse as the primary beneficiary. Seem overwhelming? This is something an experienced attorney can help you do!

- Review Your Insurance Policies.

Do either of you have any insurance policies in only one of your names? You may be able to save some money by combining your auto insurance coverage. Now that you are married and relying on one another financially, you may also want to look into a life insurance policy together. Finally, your new, shiny rings and any other personal property may be best protected by getting a policy that covers personal items.

- Prepare Powers of Attorney and Healthcare Directives.

No one likes to think about their loved ones becoming ill or getting injured; however, both of these possibilities are very real parts of life. To prepare for all eventualities, we advise that each partner creates a Durable Power of Attorney and Advance Healthcare Directive. Each of these documents gives the named person the power to make decisions on behalf of the creator if he or she is unable to act. Durable Power of Attorney is for financial decision making and Advance Healthcare Directive is for medical decisions. Before creating these documents, this is a good time to have a conversation about healthcare goals, preferences, and beliefs, and to develop a financial plan if one of you becomes sick or injured.

- Re-title Any Real Estate.

If one or both spouses owns real estate prior to the marriage, you should have a conversation about whether you want any property to be jointly owned. If you decide to co-own any property, re-title the deed by placing it in joint tenancy with the right of survivorship. This gives both spouses rights to the property, and the surviving spouse will take ownership of the property without it having to pass through probate.

- Take the Time to Start Fresh

Contrary to popular belief, estate planning isn’t some long, drawn-out process that causes a lot of stress. In fact, working with an experienced, compassionate, and efficient wills and trusts practice can be quite the opposite. As you are building a new life together with your partner, the experience of creating an estate plan (now, before the stresses and chaos of life get in the way) can be cleansing. You and your sweetheart are able to step into your married life organized, calm, and prepared. Make a day of it! Schedule your appointment with one of our experienced attorneys around a lunch date with your new spouse.

If you have a wedding in your future, or if you were recently married, give the Trust Brothers a call. Our office number is 626-331-1515. We would love to help in this joyful time of your life!

Gen X and Millennials: It’s Your Money to Lose

In our line of work, there are two main reasons why people come to an attorney for an estate plan. One is to choose guardians for minor children in the event that both parents pass away. That’s a great reason and is incredibly important. But what if you don’t have little ones running around? The other reason people usually want an estate plan is to preserve all the “stuff” (read: houses, bank accounts, family heirlooms, business interests, etc.) from falling into the wrong hands (the state, the IRS, creditors, estranged family members). The second reason, in its own way, is good too, but it doesn’t tell the whole story.

In our line of work, there are two main reasons why people come to an attorney for an estate plan. One is to choose guardians for minor children in the event that both parents pass away. That’s a great reason and is incredibly important. But what if you don’t have little ones running around? The other reason people usually want an estate plan is to preserve all the “stuff” (read: houses, bank accounts, family heirlooms, business interests, etc.) from falling into the wrong hands (the state, the IRS, creditors, estranged family members). The second reason, in its own way, is good too, but it doesn’t tell the whole story.

Start from the Beginning: What Happens to the Stuff When People Pass?

When a person passes away without a plan in place, the state (in our case, California intestacy law) decides what happens with all of the stuff left behind. There is a specific process, called probate, that includes gathering all of the person’s stuff (real estate, bank accounts, business interests, personal effects), determining the total value, satisfying any outstanding debts, and then distributing whatever is left to the deceased person’s family. The process is long, public, and incredibly expensive. Not to mention, if the stuff really should be passing to someone other than the nuclear family (as defined in the state’s default laws), it may never make it there. So, what do people do to avoid this situation? They write a will.

Even with a Will, Everything Has to Pass Through Probate

You’ve heard of people writing a Last Will and Testament to ensure that their stuff goes to the right family members or friends when they die. The will is also where people can make that important guardianship choice regarding who should step in to care for young children, if that situation arises. All in all, a will is an incredibly important document. But, there are a few things you may not know about a will.

Although wills are able to be much more specific about your intentions than the default laws in your state, they don’t actually avoid probate. Even with a will, everything has to pass through the probate process, which is still time-consuming, part of the public record, and — most of all — expensive. In the State of California, the whole probate process can end up costing between 3-6% of the total value of the estate, and that’s without any lengthy court battles about who gets what!

Be Honest, Who Really Benefits from a Well-Planned Estate?

A lot of attorneys out there are putting the guilt trip on Baby Boomers, reminding them that, if they don’t put an estate plan in place soon, their loved ones will be out of luck in the future. The standard narrative is this: 1) Get an estate plan. 2) Feel peace of mind knowing your loved ones are cared for. Of course, that sounds great, and a good number of people do end up getting their affairs in order just to feel like they’ve checked the box. BUT, let’s be honest, peace of mind isn’t a super persuasive pay-off. That’s why over 60% of Americans don’t even have so much as a will, let alone a probate avoidance estate plan.

Here’s the thing, Gen-Xers and Millennials, you, not your parents, are the ones who will benefit from their probate avoidance estate plan. And you are also the ones with the most to lose. Do you really want to go through the process of probate? Do you really want to have to wait twelve to eighteen months just to receive a dime from your parents’ wealth? Do you want the details of everything you will inherit to be available on the public record? And do you really want to lose 3-6% of the total value of your inheritance right off the top? Of course you don’t.

Let’s do the math. Say your parents own a home that’s valued at $550,000. And maybe they have about $75,000 in stocks, $30,000 in cash, and a $17,000 car. In total, that’s a $672,000 estate. You will lose, right off the top, about $33,000. Then, if they still owe anything on their house or to any other creditors, those debts will have to be paid back, too. Plus any additional court costs, appraisal costs, attorneys fees, funeral costs, the list goes on and on.

Surprise! Estate Planning is Actually in Your Best Interest

Take it from us — probate is not fun and you stand to lose a lot of money in the process. But, there is a way to avoid it. A probate avoidance trust is a relatively simple set of legal documents that keeps your parents stuff out of probate. This kind of trust, alongside a standard will, is a secure way to ensure that you are able to inherit quickly, easily, and without the hassle and expense of probate when your parents pass. To us, it’s a no-brainer. Sure, setting up a probate avoidance trust costs a little money now, but it’s nothing compared to what you will save in the long run. Talk to your parents. If they aren’t willing to put up the money to create a trust, consider offering to pay for it yourself. After all, it’s your money to lose. Consider it an investment in your future.

Want to learn more about setting up a probate avoidance trust to protect your inheritance? Give the Trust Brothers a call at (626) 331-1515.

Spring is in the Air! There’s No Better Time to Clear Out Your To Do List

Spring is a time of renewal, new growth, and possibility. Although many of us experience a burst of energy as the days grow longer and the weather gets warmer, it often doesn’t last long. In just a few weeks, our lives will begin to bustle with summertime preparations and an ever-growing To Do list. So, how can we make the most of the calm before the storm? Clear out those lingering tasks that have been sitting on the back burner for far too long! We are often surprised at how great it feels to finally cross off a long-overdue item from the list. The best part? By clearing your To Do list, you make room for all of the new and exciting adventures that lie ahead!

Spring is a time of renewal, new growth, and possibility. Although many of us experience a burst of energy as the days grow longer and the weather gets warmer, it often doesn’t last long. In just a few weeks, our lives will begin to bustle with summertime preparations and an ever-growing To Do list. So, how can we make the most of the calm before the storm? Clear out those lingering tasks that have been sitting on the back burner for far too long! We are often surprised at how great it feels to finally cross off a long-overdue item from the list. The best part? By clearing your To Do list, you make room for all of the new and exciting adventures that lie ahead!

Start Small with a Call

One of the reasons why big To Do list tasks often go undone is that they are too large to accomplish all in one go. By listing one big thing on our list like, “Do Estate Plan,” we are basically guaranteeing that we won’t act on that task. It takes too long, and the process is unknown. It’s like putting “Buy a House” on your list. What are the steps? Where do you even begin?

We’ve all heard the saying, “How do you eat an elephant? One bite at a time.” While this kind of gross metaphor always has me picturing a cartoon tying a napkin around his neck and licking his lips, the sentiment rings true. The only way to accomplish a big and unknown task is to break it down into small, actionable steps.

For estate planning, step one is making that first phone call. Get in contact with an attorney you connect with (through their social media, website, or articles), and set up an appointment. Don’t put anything more than that on your list! Keep it small and simple: Call Estate Planning Attorney. It takes about five minutes, and it is an easy way to make progress and put something in the “Win” column.

If you have connected with us here at The Trust Brothers, through our social media, our blog posts, our e-newsletters, or even in person, feel free to give us a call! Our office phone number is (626) 331-1515. You’ll be done with step one and crossing it off your list in no time.

Complete the Attorney’s Intake Procedure

What’s step two? That’s the beauty of step one! Once you’ve called and spoken with an estate planning attorney, he or she will lay out a clear set of steps for you to follow through their intake procedure. Don’t group them together by writing “Complete documents for EP attorney” on your list! Keep steps small and actionable. With The Trust Brothers, step two is to complete a questionnaire sent over by our team. At first, it may look a little intimidating, but don’t be daunted! It actually should take you less than an hour to complete, and it can even be broken down into micro-steps by putting each individual page on your To Do list. Complete one page a day with your favorite beverage of choice. Make it some quiet time just for you. Remember, don’t let yourself get overwhelmed or stressed. When that happens, nothing happens. Overwhelm is a sure-fire way to get nothing done. So keep the tasks small and don’t try to take on too much. You are a busy person! One page a day of the questionnaire. Then, a separate task on the To Do list for scanning and emailing it back to us.

Give Yourself Time for Your Meeting and Make it a Day!

Here it comes! The appointed day for your scheduled meeting with an estate planning attorney. Make sure that you have given yourself enough time to get to your meeting, so you aren’t rushing or thinking about a thousand things on your way over. Actually, we really recommend taking at least a half-day of self care on your attorney consultation meeting date — not because the meeting will take that long (it really shouldn’t take more than an hour) but so that you can build ease and relaxation into the day. You are finally doing something important and necessary that’s been simmering on the backburner for years. Reward yourself for that! Take yourself out to your favorite coffee shop with a good book. If you are bringing your partner along with you to the meeting, make it a date! Enjoy lunch together before or after your attorney meeting.

Sit Back, Relax, and Let Us Take it from Here

Once you’ve walked in the doors at our office, you can breathe a sigh of relief. Let us take it from here! From now on, we will be guiding you through the estate planning process and doing the bulk of the heavy lifting. Of course, we want you to remain involved and engaged throughout the process, but that mostly means answering our emails and taking our calls to answer questions. We do all of our estate planning work on a flat-fee basis, so you don’t have to worry about racking up hourly bills or getting charged more if you want to ask questions and take your time. Just relax! Your estate plan is almost done, and your To Do list is already so much clearer. The next steps (returning to our office for a signing meeting and retrieving your executed documents) are simple, short, and very doable. Remember that we are here for you, so any kind of support you need to make this process easier, we want to provide. All you have to do is ask.

Take the First Bite by Making a Commitment to Yourself

Often, there is a pre-step one that is the hardest task of all. It’s the one that comes before even making the phone call to set up an appointment with an attorney. The pre-step first task is just to make the commitment — to say to yourself, “I am going to complete my estate plan this spring.” If you are ready to take this first bite of the elephant, all of the rest of the steps will fall into place.

Ready for step one? Write it on your To Do list and get it done by the end of the day: give our office a call at (626) 331-1515 to get started.

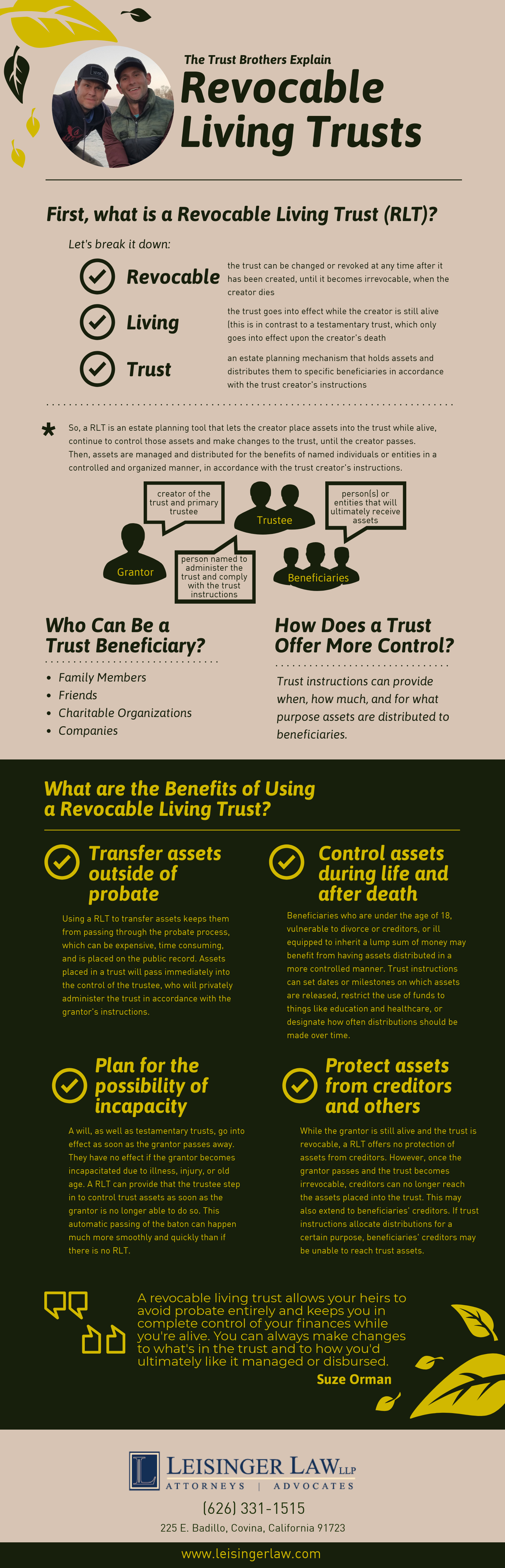

What Is A Revocable Living Trust?

We are going to take a step back, rein in some of the lawyer-y talk, and start from the basics. What even is a Revocable Living Trust? It’s a big name, and it sounds just boring enough to be something you don’t need. If you still think a Revocable Living Trust is too fancy or too technical for you and your loved ones, that’s our bad. That means we haven’t been taking the time to lay out what a Revocable Living Trust really is, and what it can do for your family.

No more! This week, we have created a great graphic that walks you step-by-step through the basics of a Revocable Living Trust. We are also going LIVE this week on Facebook to talk through the basics. Then, if you have any questions, feel free to give us a call for a complimentary Trust Brothers Planning Consultation. We want to make sure you are aware and informed about all of your options!

How to Leave Assets to a Loved One Who Struggles with Addiction

In the United States, 21.5 million adults (aged 12 or older) battle with some kind of substance abuse disorder. The opioid epidemic is on the rise, and addiction affects many families nationwide. Decades of research show that addiction is a chronic illness, and many in recovery have one or more relapses (60% of patients relapse within one year of receiving treatment, according to the Journal of the American Medical Association). Relapse, rather than a failure, is a common part of recovery.

In the United States, 21.5 million adults (aged 12 or older) battle with some kind of substance abuse disorder. The opioid epidemic is on the rise, and addiction affects many families nationwide. Decades of research show that addiction is a chronic illness, and many in recovery have one or more relapses (60% of patients relapse within one year of receiving treatment, according to the Journal of the American Medical Association). Relapse, rather than a failure, is a common part of recovery.

For families with loved ones who struggle with addiction, finding the right way to show caring and compassion can be a challenge, especially in the form of financial support. When planning to distribute your hard-earned assets to your heirs, having a loved one with addiction can make things a little more complex. However, there are ways to structure your estate plan to ensure that your loved one is cared for. All estate plans should be carefully tailored to suit the unique needs of each individual — providing for a loved one with addiction is no different.

If You Have a Beneficiary Who Struggles with Addiction, No Estate Plan is Not an Option

If you have a loved one or beneficiary who struggles with addiction, you need an estate plan. Without one, your heir will likely receive any assets they would be entitled to upon your death in a lump sum payment. This inheritance can pose a challenge for someone who is struggling with substance abuse and for some individuals who are in recovery. Receiving a large amount of money all at once can make your loved one vulnerable to overdose, relapse, and being taken advantage of by others. Leaving assets to another family member with an understanding that they will provide for the beneficiary with addiction is not a great option, either. There is no way to enforce such an understanding, and it puts the family member responsible for making distributions in an awkward, or even dangerous, position.

Use a Trust to Manage Distributions

A trust allows you to exercise more control over how and when the distributions of assets are made. Trusts are endlessly customizable and can be specifically designed to provide for your beneficiary. You know your loved one best, and you want to act in their best interest.

You could choose to create a simple trust that slowly distributes your loved one’s inheritance over time, without any restrictions on how the money is used. Or, you could create an “Addiction Trust,” an incentive trust designed to provide the minimum living needs for the beneficiary while also providing financial incentives to seek help and maintain recovery.

Depending on the specific needs of your beneficiary, trust instructions can

● Pay directly for the basic requirements of the beneficiary (including rent, mortgage, college tuition, food, etc.)

● Require the beneficiary submit to random testing

● Provide access to additional funds or services that increase their quality of life in exchange for maintaining recovery

● Prevent the trustee from ever making cash distributions to the beneficiary and avoid purchasing anything for the beneficiary that can be converted to cash

● Provide for the payment of rehabilitative and treatment programs

Like any trust, an Addiction Trust is overseen by whomever you appoint as trustee. However, it is especially important that the trustee be a dispassionate, third party, rather than a family member or close friend. Many trust grantors choose to name a trusted family member or friend to administer a trust. However, in the case of an Addiction Trust, a personal relationship between the trustee and the beneficiary may not be the best idea. Instead, you can choose a professional fiduciary (such as an attorney or a bank) to represent your beneficiary’s interests. If you are unsure how to find an appropriate trustee, your estate planning attorney can help.

An Addiction Trust is about More than Control

If a loved one struggles with an addiction or substance abuse, it can be stressful to imagine what will happen to them after you are gone. You want to plan for and provide for their wellbeing, and you want to ensure they have the means to provide for themselves, but you don’t want any support they receive to be misused or to support any destructive behaviors. So, what do you do? Creating an Addiction Trust or other estate planning mechanism is not about exercising control or punishing your loved one. Truly, this is about compassion, caring, and recognizing that every individuals’ needs are different.

At Leisinger Law, our compassionate attorneys are prepared to help you design a unique, one-of-a-kind estate plan for your family. We believe that every client’s legacy is important and should be carefully protected and preserved. To do this, we take our time getting to know you and working alongside you to craft an estate plan that works for you. Feel free to give us a call at (626) 331-1515.

A Clear and Compassionate Plan Can Help Avoid Hurt

On March 4, 2019, America lost one of its favorite heartthrobs. Luke Perry (Coy Luther Perry, III) passed away after a tragic and unexpected illness. At the age of 52, he suffered a stroke, was hospitalized, and five days later, when it was clear he would not recover, his family made the decision to remove life support. In this devastating time, it seems that Luke Perry’s family was able to take swift and decisive action. Although his exact estate planning documents have not been made public, many are crediting his family’s ability to act quickly and without public embattlement to Mr. Perry’s forethought in creating a plan.

Make a Plan from a Place of Strength, Not Fear

Often, we see estate planning done (or not done) out of fear. Families tend to believe that preparing for worst-case scenarios either gives too much weight to things that may never happen or somehow prevents bad things from happening altogether. It’s human nature to be a little superstitious, but it’s not the best strategy for making major decisions.

Instead, it’s best to be practical. Of course, estate planning is an emotional topic, and that’s why it’s so important to work with a compassionate professional you like. However, it is equally important to take a pragmatic approach to put plans in place that create the best possible result if the worst possible thing occurs.

It’s Not Morbid to Admit You Don’t Know the Future

It’s not morbid to admit you don’t know the future — it’s kind. The difficult, the unexpected, and the painful may occur and having a plan in place is the most caring way you can prepare your loved ones to handle stressful and emotional situations.

Consider Luke Perry’s situation: if he did, in fact, have a clear Advance Healthcare Directive in place, naming a health care proxy to make medical decisions on his behalf, and a Living Will, indicating that he wished for life support to be removed when it became clear that he would not recover, these painful decisions would be much less confusing and stressful for his family. And if, as seems to be the case, he created a Revocable Living Trust providing for his adult children in the way that made sense for his family, they will be spared the cost, time, and stress of enduring a prolonged, expensive, and public probate process.

Create a Plan that Supports Your Loved Ones

In your own life, do you have a plan in place to support your loved ones if something happens to you? A will is a great place to start (it gives the court instructions on how you want your assets distributed after you’re gone and, if you have minor children, names your preferred guardian), but it won’t do anything to help if you suffer a sudden illness or incapacity. Unlike other estate planning documents, a will only goes into effect after you have died. What this means is, if you become ill or injured and are unable to communicate your wishes (medical, financial, and with regard to your children and your business), someone else will step in to make these critical decisions for you. Not only may this create a result that you would not have chosen, but it also can breed conflict among your loved ones.

Here’s an example: if you are injured in a car accident and are temporarily unable to communicate your wishes, who will pay your mortgage on time? Who will tell the doctor which medical procedures you would or would not consent to undertake? Who will make critical decisions about your business? What should those decisions be? The questions are endless, and inside of each one is the opportunity for disagreement among those most important to you. When emotions are running high during a crisis, it is not the best time to be making important and life-changing decisions.

Instead, take a step back. You have a unique opportunity to avoid all of the potential hurt and conflict and confusion that could lie ahead. Outside of a moment of crisis, you can make decisions now about how you would want stressful and traumatic situations to be handled. Then, if and when the time comes, there are clearly communicated instructions to follow. It’s a bit like writing a letter to your future self — except an estate plan is legally enforceable.

You Don’t Have to Go Through this Process Alone

At this point you may be thinking yes, of course having a plan in place sounds better than no plan at all. But, you have no idea where to start. You don’t even know what kinds of decisions will need to be made or how to initiate these conversations with your loved ones. Guess what? You don’t have to do this alone.

At Leisinger Law, our compassionate, experienced estate planning attorneys take the time to get to know you and your family. The Trust Brothers are committed to walking you through the entire estate planning process to make sure that you understand what decisions need to be made and that you feel supported to create plans that support your decisions. Our attorney-client relationships are built on trust, and we are here to make sure that you feel prepared for whatever lies ahead. Give our office a call to begin the process: (626) 331-1515.

Personal Representative’s Guide to California Probate

If you have recently been appointed as the personal representative of an estate in California or if you are drafting your will now and trying to decide whom to choose to administer your estate, this guide is for you.

If you have recently been appointed as the personal representative of an estate in California or if you are drafting your will now and trying to decide whom to choose to administer your estate, this guide is for you.

What is Probate?

Probate is a court procedure by which a decedent’s estate is gathered, assessed, and distributed to any valid creditors left behind and to the beneficiaries of the deceased person’s estate.

Not all assets will be considered a part of the decedent’s estate for the purposes of probate. Financial assets with a beneficiary designation will pass outside of probate to the named beneficiary. A properly set up and funded trust will also keep assets out of probate, and they can be distributed immediately and without Court approval in accordance with the trust terms and instructions. Remaining assets will be distributed in accordance with a valid will through the probate process. If there is no valid will, the estate is considered “intestate” and will be transferred to heirs in accordance with California laws of intestacy.

How Long Does Probate Take?

The average probate administration can take between six and eighteen months, depending on the complexity of the estate. In California, there is a “simplified procedure” for estates that meet certain qualifications (between $20,000 and $150,000 in assets, among other requirements).

What is a Personal Representative?

You may have heard the term “executor” used to describe the person who administers an estate. In the State of California, this person is called the “personal representative.”

The personal representative is responsible for administering the will on behalf of the decedent in accordance with the terms of the will. Throughout the probate process, the personal representative is held legally responsible for protecting the decedent’s assets (including his or her home, savings, personal property, and any other probatable asset). This legal responsibility, or fiduciary duty, requires that the personal representative must at all times act and make decisions in the best interest of the estate.

Although the personal representative is named in a deceased person’s will, the role is actually conferred by the Probate Department of the Superior Court. A personal representative is an officer of the Court, and the Court appoints this person and holds he or she accountable. Personal representative duties do not commence until the Court Clerk issues “Letters Testamentary” to the personal representative.

If the personal representative designated in the will is unwilling or unable to serve, a successor representative can step into the role or the Court can designate a replacement.

Who is Qualified to be a Personal Representative in the State of California?

A personal representative may be an individual (usually a trusted friend or relative), bank, or trust company. To be qualified as a personal representative, this person (or entity) must meet the following requirements:

– Over the age of 18

– Not disqualified by the Court as unsuitable.

What Does a Personal Representative Do throughout the Probate Process?

Serving as a personal representative can be a lot of pressure (especially if the will is contentious, assets are difficult to locate, heirs are anxious to receive their inheritances, or there are a lot of creditors seeking to be paid out of the estate), and there is a lot to do. The best way to get through the process is to remain organized and follow each step of the process methodically.

In order to fulfill his or her administrative duties under California law, the personal representative must:

- Obtain the decedent’s Death Certificate. The personal representative is often responsible for the funeral and/or burial arrangements. The funeral home can issue as many death certificates as are needed.

- Find estate planning and other important documents. In addition to the will, the personal representative should also attempt to find paperwork related to insurance, investment accounts, funeral plans, bank accounts, real property, valuables (and documents that verify the value of antiques and collectibles), business interests, and any other documents that can help value the estate.

- If the decedent had a will, the personal representative needs to locate and submit it to the Court within 30 days of the individual’s death. The personal representative named in the will is responsible for filing a petition for probate with the Superior Court.

- Identify and properly value the decedent’s probate assets. Within four months of being appointed, the personal representative must file with the Court an inventory of the property to be adminstered in the probate proceedings. This inventory should include all real property, investments, bank accounts, personal property, and any other probatable assets that comprise the decedent’s estate. Sometimes, the deceased person will leave the personal representative a list of assets and where to find them. However, it is not always this easy.

The documents listed above, as well as any other information regarding assets, may be found in a file cabinet or safe deposit box. If there is no clear place where documents are held, the personal representative should check with the attorney who drafted the decedent’s will. He or she may have a record of assets on file. Once a list has been found or created, the personal representative will need to determine the total value of the estate.

- In California, the personal representative has a duty notify all known or reasonably ascertainable creditors to whom the decedent was indebted. Notice should be given by completing the Notice of Adminsitration to Creditors form and mailing it to each known creditor, within the later of

- Four months of the date the personal representative was appointed, or

- Thirty days after the personal representative was made aware of the creditor.

- During the period when creditors are making claims against the estate, the personal representative should spend time valuing, consolidating, and liquidating assets to allow for distribution. The personal representative is responsible for hiring any professionals needed to properly administer the estate (including attorneys, CPAs, appraisers, and investment advisors).

- Defend the estate from improper claims and pay all valid claims. The estate is responsible for paying the valid creditor claims of the deceased person. Claims should either be accepted or rejected within thirty days of receiving each claim. If the amount of all valid claims exceeds the total value of the estate assets, the heirs are not responsible for covering the balance. The Court will prioritize the creditors if there are not enough assets to cover all valid creditor claims. Absolutely no distributions should be made to anyone before the Court determines that all creditors have been paid.

- File any required tax returns and pay any outstanding taxes due.

- Pay the expenses associated with administering the estate.

- Distribute all remaining assets in accordance with the will.

When Does the Probate Process End?

After all valid claims have been paid, the personal representative can submit a final account and petition for distribution to the probate court. This petition will be set for a hearing, and the Court will issue an order approving the final distribution to any heirs.

Can a Personal Representative Be Compensated for His or Her Work?

In the State of California, the personal representative is entitled to compensation from the estate for his or her services. By statute, personal representatives can earn a fee of 2-4% of the probatable estate. As the size of the estate increases, the percentage decreases. The personal representative is also entitled to reimbursement for reasonable expenses such as the cost of death certificates, travel costs, engaging professional services, etc. Any fees paid to the personal representative must be approved by the Court.

Can a Personal Representative Hire Professionals to Help?

It is highly recommended that personal representatives do not attempt to navigate this process alone. A team of professionals with the proper experience can make the probate process a much smoother and more manageable one and can help avoid costly mistakes. An experienced probate attorney is highly recommended and will guide the personal representative through the legal steps of the probate process. He or she can also serve a valuable communications role when dealing with family members and beneficiaries.

A tax professional will likely be necessary to file any final tax returns and assess tax liabilities that may arise from the inherited assets.

Appraisers will also likely be necessary to determine the fair market value on real estate, antiques, collectibles, and any other assets of undetermined value.

Ask a California Probate Attorney for Assistance

If you are named a personal representative in a California will, or have questions about serving in such capacity, you should seek the counsel of an experienced probate attorney, like the ones at Leisinger Law, for assistance. Even in the simplest of probate estate matters, many legal issues can arise. To learn more about administering a probate estate in California, give us a call at our Covina office, at (626) 331-1515, to schedule an appointment with one of our experienced probate attorneys today!